travel nursing tax home audit

After the renewal a percentage of licensees are randomly selected for audit of CE and practice requirements. The Common Services Policy sets a strategic direction and provides authority to reform administrative management and the role of common service organizations CSO to create a more streamlined efficient and responsive Public Service.

How Often Do Travel Nurses Get Audited Tns

If you receive an audit letter based on your 2021 TurboTax return we will provide one-on-one question-and-answer support with a tax professional as requested through our Audit Support Center for audited returns filed with TurboTax for the current tax year 2021 and the past two tax years 2020 2019.

. Rosabon Financial Services Limited is recruiting to fill the position of. Search all the open positions on the web. The nursing assessment is a systematic and structured process utilized by a nurse when collecting a patients set of information.

Federal tax forms and publications are available by calling. Tax Sale Excess Proceeds. This process is also considered as the first phase in the nursing phase and the first step when one is tasked to provide nursing care to the.

EWU Nursing Program Earns Approval to Move Ahead 08252022 08262022 The nursing program will operate inside the SIERR Building with its first student cohort arriving in. Mandatory Duty to Report. Recorded Tele-Tax Service on federal tax topics or tax refund information is available by calling.

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Types of Recorded. That is w3hy it is very important to examine the physical condition of the patients before making the nursing college assessment form.

Read reviews on over 600000 companies worldwide. Audit of the Appellate Tax Board ATB. The governments White Paper on Public Service 2000 The Renewal of the Public Service of Canada December 1990.

Interested candidates should possess a Masters Degree in Accounting Finance or any other related field with a minimum of 8 years relevant work experience. Review of Payments for Nursing-Facility Claims PDF 76703 KB Open PDF file 68469 KB for Southeast Division of the Housing Court Department. We will not.

Interview with Mark from Meridian Staffing. What is a tax home and what do you need to do to maintain it. Property Tax Division 530621-5470 or Email sallyzutteredcgovus.

Federal Tax Assistance Federal tax account or technical information and problem solving are available by calling. Bloomberg Industry Group provides guidance grows your business and remains compliant with trusted resources that deliver results for legal tax compliance government affairs and government contracting professionals. We would like to show you a description here but the site wont allow us.

Nurses can create an improper nursing plans and programs with an improper nursing assessment of any patient. The position is located in Lagos State. Tax Abatements and Exemptions.

Act 50 Application Process. 17 photos TV Schedule. Overview of taxes and travel nursing.

Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see 20-30000 of non-tax reimbursement payments in a typical year of work as a travel nurse. Tax Abatements and Exemptions. Information related to property available for sale should be directed to the Tax Collector at 530 621-5800.

19-0152 40 WTD 216 2021 11302021. Our professional courteous staff provides assistance to all travelers regarding entitlements and regulatory guidance. All the gathered information is recorded in Nursing Assessment Forms.

Ivana Trump passed away in her New York home at age 73. Child tax rebate checks mailed out in Connecticut gov. We find that hunting guide services were indeed subject to retail sales tax throughout the audit period and the guides lack of knowledge regarding its tax liability is not a valid basis for a penalty waiver.

Audit Jobs in Uganda 1090 Aviation Jobs in Uganda 255 Banking Jobs in Uganda 3687 Bids and Tenders 4 Business Administration Jobs in Uganda 19323 Communications Jobs in Uganda 1938 Customer Service Jobs 220 Economics Jobs in Uganda 3847 Education Jobs in Uganda 2792 Embassy and Foreign Mission Jobs in Uganda 690. For more information about CE requirements and audits click on the Continuing Education and Audit Information webpage or see Section 90 in the Nursing Rules and Regulations and Question 10 in the Frequently Asked Questions. For Massachusetts Office of Travel and Tourisms Administration of Regional Tourism Grant Awards PDF 7122 KB Open PDF file.

LERTA Act 76 Application. Tax sale is the sale of secured property by the Tax Collector at public auction sealed bid sale or sale by agreement to satisfy defaulted secured taxes. Form 990 is an annual information return required to be filed with the IRS by most organizations exempt from income tax under section 501a and certain political organizations and nonexempt charitable trustsParts I through XII of the form must be completed by all filing organizations and require reporting on the organizations exempt and other activities finances governance.

View All Programs. License Law Title 24 Ch 19 License Law Title 24 Ch 19A Rules. Find the one thats right for you.

This assessment can be regarded as the base of the entire nursing process. Continuing Education and Audit Information. The Financial Services Center offers a end-to-end travel Web-based travel system which automatically allows users to arrange travel book reservations submit travel expenses and reconcile payments.

Get your own personalized salary estimate. Head Internal Audit and Compliance. Audit Support Guarantee.

Taxes and Travel Nursing.

Are There Red Flags For The Irs In Travel Nursing Pay Bluepipes Blog

How Much Rent Do I Need To Pay Tax Home Q A For The Travel Nurse Therapist Tech By Nomadicare Medium

Your Travel Nurse Tax Guide Premier Medical Staffing Services

5 Frequently Asked Travel Nurse Tax Questions

Answering The Most Asked Travel Nurse Tax Questions Nurse First Travel

How Often Do Travel Nurses Get Audited Tns

Tax Tips For Financially Savvy Travel Nurses Nomad Health

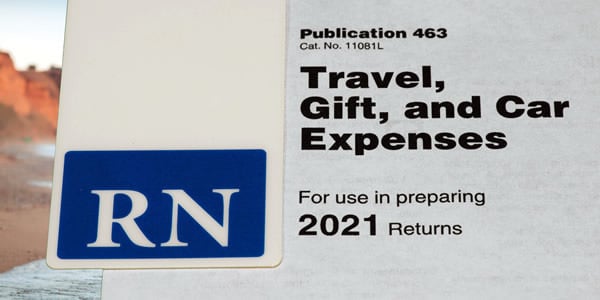

Travel Nursing Versus The Irs Irs Publication 463 Travel Nursing Allnurses

Healthcare Travel Taxes For Pas Nps And Allied Workers 6 Things To Know

How Often Do Travel Nurses Get Audited Tns

What Travel Nurses Need To Know About Taxes Nurse Recruiter

How Much Rent Do I Need To Pay Tax Home Q A For The Travel Nurse Therapist Tech By Nomadicare Medium

Travel Nursing Versus The Irs Irs Publication 463 Travel Nursing Allnurses

How Often Do Travel Nurses Get Audited Tns

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

Travel Tax The Travel Nurse S Guide To Taxes Travel Nursing

How Much Rent Do I Need To Pay Tax Home Q A For The Travel Nurse Therapist Tech By Nomadicare Medium